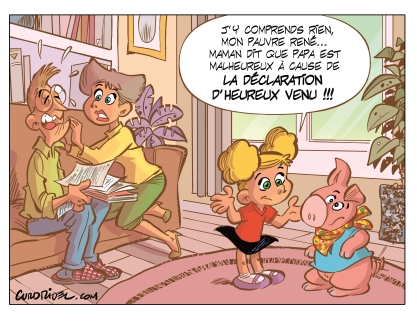

April: the tax return

ADAGP Comic Book Commission publishes the Comic Book Calendar for comic book authors. Get the latest news each month on key moments in the careers of comic book authors and important information on your rights, tax and social security status.

Illustration: Curd Ridel

© ADAGP, Paris, 2024

Artistic income, including royalties, is taxable income and must be declared on the annual tax return, in the spring following receipt.

Please note: the decree of 28/08/2020 on the nature of the activities and income of Artist-Authors redefines the principal and accessory activities generating artistic income (see page "December - artistic income").

Artistic income may be taxed under two different regimes:

- The salaries and wages (Traitements et salaires - TS)

This system only applies to royalties that have been fully deducted by your distributors or society of authors.

No SIRET number is required.

An allowance of 10% will be applied to the amount of TS to determine your tax base.

- Non Commercial Profits (Bénéfices non commerciaux (BNC)

This system applies to income not subject to withholding tax, such as sales of works, royalties not subject to withholding tax, and "accessory " activities.

You can choose to declare all your income as non-commercial profits, including that paid by publishers, producers or ollective management organisation (CMO) such as ADAGP.

The SIRET number is mandatory for Non Commercial Profits declarations. If you do not have one, you can obtain it from the one-stop shop: https://formalites.entreprises.gouv.fr/

Le régime des BNC propose deux options fiscales :

- "Micro BNC" (flat-rate fees) : a 34% allowance corresponding to a flat-rate estimate of your professional expenses is applied;

- "Déclaration contrôlée" (actual expenses) : this option, which allows you to deduct your business expenses on an actual basis, is the most attractive if they represent more than 34% of your sales.

Update your advance payment

Whatever your tax system, you are now subject to a contemporary monthly or quarterly advance payment deducted from your bank account. Calculated until July on the basis of income declared in N-2, then from August to December on that declared in N-1, the amount deducted is updated in September each year.

Has your income changed significantly? Request an update of your advance payment: www.impôts.gouv.fr.

Please note : a surcharge will be applied if there is too great a difference between the adjustment requested during the year and the actual income declared the following year.

2024 tax return dates for 2023 income: from April 11, 2024 (as every year, the deadline depends on the number of your département of residence).